Issues Making Offers on Disney DVC

Posted On December 18, 2025

Making offers on DVC resale contracts involves understanding common issues that can complicate or derail transactions. Recognizing these challenges before submitting offers helps buyers navigate the process more effectively and avoid costly mistakes.

Right of First Refusal Complications

Disney's Right of First Refusal (ROFR) represents the most significant hurdle in DVC resale purchases. After an offer is accepted, Disney has approximately 30 days to either purchase the contract at the agreed price or waive their right. Disney exercises this option on approximately 15-25% of submitted contracts, though rates vary significantly by resort and pricing.

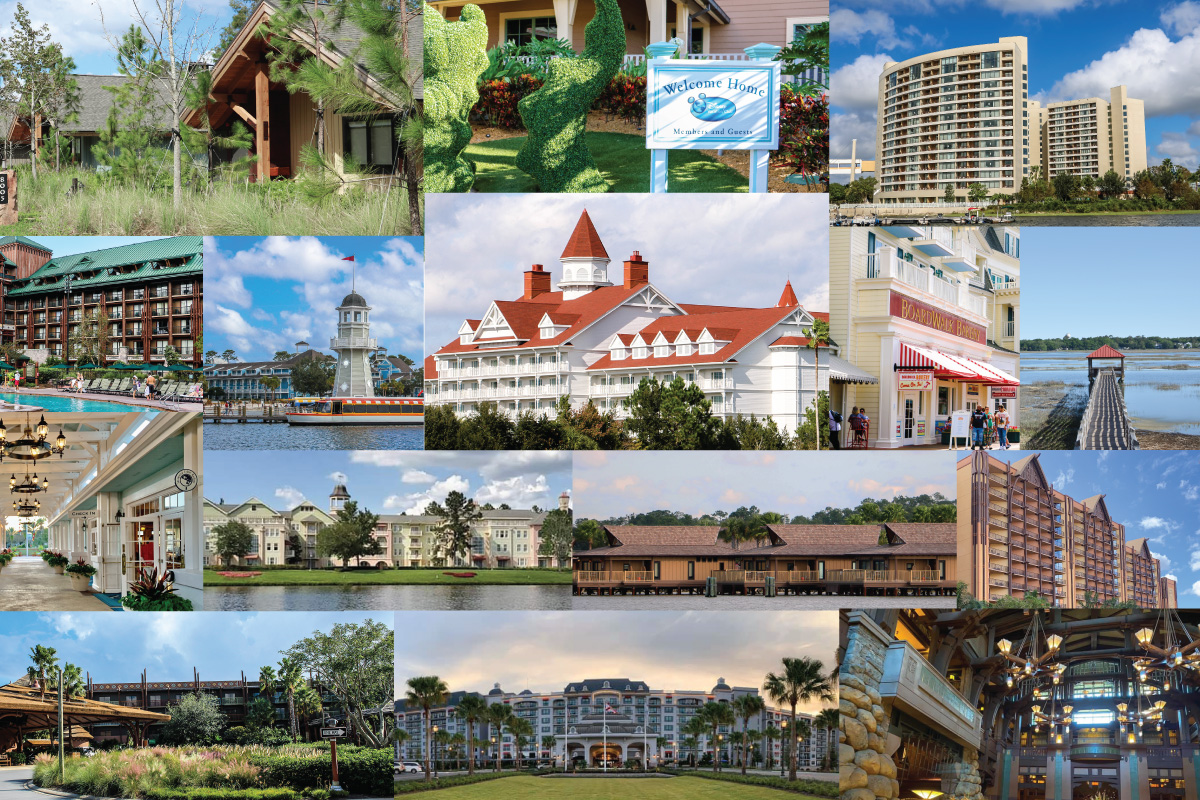

Common ROFR issues include offers priced too far below market value, which almost guarantee Disney buyback. Contracts at desirable resorts like Polynesian, Bay Lake Tower, or Copper Creek face higher ROFR rates than older properties. Buyers can minimize rejection risk by researching recent comparable sales and offering competitive prices rather than seeking extreme discounts.

Contract Accuracy Problems

Inaccurate listing information creates significant offer complications. Common discrepancies include incorrect point allocations, wrong use years, unreported banked or borrowed points, and existing reservations that transfer with ownership. Discovering these errors after offer submission often requires contract amendments or complete deal cancellation.

Buyers should request detailed contract documentation before submitting offers. This includes the original deed, most recent dues statement, current point balance showing banked and available points, and confirmation of any existing reservations. Reputable brokers provide this information proactively; those who hesitate may indicate underlying contract problems.

Ensuring Accurate Information

To ensure accuracy, potential buyers should work with brokers who have a track record of transparency and accuracy. Verifying all details with the current owner and cross-referencing with available documentation can prevent future disputes. This diligence can save both time and money, avoiding the need for contract renegotiations.

Financing and Payment Issues

DVC resale purchases typically require cash payment since traditional mortgages rarely cover timeshare transactions. Buyers planning to finance purchases must secure timeshare-specific loans with higher interest rates (typically 12-18%) before making offers. Contingent offers dependent on financing approval face higher rejection rates from sellers.

Payment timing creates additional complications. Earnest money deposits (typically $500-$2,000) must be available immediately upon offer acceptance. Remaining balances are due at closing, usually within 10-14 days after ROFR waiver. Buyers lacking readily available funds may lose contracts to faster-closing competitors.

Planning Financials in Advance

Prospective buyers should have their financial arrangements in place before making an offer. This includes securing necessary funds and understanding the financial obligations associated with DVC ownership, such as annual dues. Being financially prepared not only streamlines the process but also positions buyers as serious candidates in competitive situations.

Seller Communication Breakdowns

Transactions involving unresponsive or unreliable sellers create substantial complications. Sellers must sign multiple documents throughout the process, including initial contracts, ROFR submissions, and closing documents. Delays at any stage can extend timelines significantly or cause complete transaction failure.

Brokers working with motivated, responsive sellers generally disclose this status in listings. Contracts from estate sales, divorcing couples, or financially distressed sellers may offer pricing advantages but frequently involve communication challenges, probate requirements, or competing creditor claims that complicate closings.

Ensuring Smooth Communication

Buyers should prioritize clear and frequent communication with sellers and brokers. Establishing expectations at the outset can help mitigate misunderstandings. Utilizing a broker who is adept at managing complex transactions can also facilitate smoother communication and resolution of potential issues.

Title and Deed Issues

Title complications occasionally surface during closing preparation, creating unexpected obstacles. Common issues include liens against the property, unpaid maintenance fees, incorrect ownership documentation, or recording errors from previous transfers. Title companies performing due diligence identify these problems before closing, but resolution can take weeks or months.

Buyers should confirm sellers are current on all dues and assessments before making offers. Delinquent accounts create cloud on title that must be cleared before transfer. Some contracts have years of unpaid dues that sellers cannot afford to clear, making the property effectively unsaleable despite being listed.

Title Insurance and Due Diligence

Obtaining title insurance can protect buyers from unforeseen title issues. Conducting thorough due diligence with the assistance of a title company ensures that buyers are aware of any encumbrances or legal complications. This foresight can prevent costly delays and ensure a smoother transaction.

Multi-Party Ownership Complications

Contracts owned by multiple parties require all owners to agree on sale terms and sign closing documents. Divorced couples, inherited properties with multiple heirs, or business partnership-owned contracts frequently encounter coordination problems. One uncooperative owner can prevent otherwise completed transactions from closing.

Before making offers on multi-party contracts, buyers should confirm that all owners have agreed to sell and will participate in the closing process. Brokers experienced with complex ownership situations can often identify potential problems before offers are submitted.

Coordinating with Multiple Owners

Engaging a broker skilled in handling multi-party contracts can help facilitate agreement among all owners. Clear communication and documentation of sale terms are essential to ensure that all parties are aligned and committed to the sale process.

Offer Strategy Mistakes

Buyer-side errors frequently undermine otherwise viable offers. Common mistakes include offering too aggressively low (triggering immediate rejection), failing to specify important contract terms, including unrealistic contingencies, or submitting offers on multiple contracts simultaneously without ability to purchase all if accepted.

Effective offer strategy involves researching recent comparable sales, understanding seller motivations, and presenting clean offers without excessive conditions. Serious buyers typically offer within 5-10% of asking prices on fairly-priced listings rather than submitting lowball offers that waste everyone's time.

Crafting a Competitive Offer

To craft a competitive offer, buyers should consider the current market conditions and the specific attributes of the contract. Engaging a knowledgeable broker can provide insights into pricing strategies that align with both buyer goals and seller expectations, increasing the likelihood of a successful transaction.

Timing and Availability Concerns

DVC resale inventory fluctuates constantly, with desirable contracts often receiving multiple offers within hours of listing. Buyers who delay decision-making or require extended due diligence periods frequently lose preferred contracts to faster-acting competitors. Popular resort and point combinations may only appear every few weeks.

Successful buyers typically prepare financials, complete broker relationships, and understand their target contracts before actively searching. This preparation enables immediate action when suitable listings appear, reducing the frustration of repeatedly missing desired opportunities.

Staying Prepared and Informed

Remaining informed about market trends and maintaining readiness to act quickly are key to securing desired contracts. Working with a well-connected broker can provide access to new listings promptly, giving prepared buyers an edge in competitive situations.

Avoiding Common Offer Problems

Minimizing offer complications requires preparation, realistic expectations, and professional guidance. Working with experienced DVC resale brokers who understand common pitfalls helps buyers navigate the process efficiently. Understanding that some complications are unavoidable but manageable reduces frustration when challenges arise during otherwise successful transactions.

- Conduct thorough research: Understand the market and resort-specific trends.

- Engage professional assistance: Utilize experienced brokers and title companies.

- Prepare financials in advance: Ensure funds and financing are secured before making offers.

- Maintain clear communication: Ensure all parties are informed and responsive.

By following these guidelines, buyers can enhance their chances of successfully navigating the DVC resale market and securing their desired vacation ownership.