Buying

75 articles

Best DVC Resale Broker

Selecting the Right Broker Choosing the right DVC resal...

How do I tell if a DVC listing is fairly priced?

Understanding DVC Listing Prices One of the most common c...

DVC Resale Sites

DVC resale sites connect buyers with Di...

Best DVC Resale Sites

Finding the right DVC resale site is crucial for a success...

Understanding DVC Resale contract Restrictions

Understanding DVC Resale Contract Restrictions When purchas...

Best DVC Resale Site Renamed

Choosing the right DVC resale site and broker significantly...

How DVC Sales Works

Experience a transparent, expert-led resale process with DV...

Linking a DVC Resale Purchase to Your Disney Account

Linking a DVC Resale Purchase to Your Disney Account After...

DVC Resale: Seller Banking Requests

Understanding Seller Banking Requests in DVC Resale Transact...

Adding my Disney DVC to a trust?

Benefits of Adding Your DVC Membership to a Trust Adding yo...

Add Resale Contract to DVC Account

Understanding Disney DVC Resale History

Understanding Disney DVC Resale History The Disney Vacation...

DVC Resale Points

DVC Resale Points: Understanding What You're Buying DVC res...

Disney Resale DVC

Disney Vacation Club resale refers to the secondary market...

DVC Points Resale

The DVC points resale market offers Disney Vacation Club me...

Can You Buy DVC Resale from Disney?

What Does It Mean to Buy DVC Resale Directly from Disney? W...

Buying DVC Resale from Disney

Buying DVC Resale from Disney: Clarifying a Common Misconcep...

Buying DVC Resale Direct from Disney

Buying DVC Resale Direct from Disney: Understanding Your Opt...

Buying Resale DVC Points

Buying Resale DVC Points: Your Step-by-Step Guide Buying re...

Buy DVC Timeshare Resales

Buy DVC Timeshare Resales: Understanding Your Options Buyin...

Buy DVC Resale Points

Buy DVC Resale Points: Your Complete Guide Purchasing DVC r...

Buy DVC Resale Contract

Buy DVC Resale Contract: A Complete Guide Purchasing a...

Buy DVC Points Resale

Buying DVC points on the resale market offers substantial s...

Buying DVC Points Resale

Buying DVC Points Resale: A Smart Approach to Disney Ownersh...

Buy DVC Resale

Buying DVC resale provides access to Disney Vacation Club...

DVC Resales Listings | Buy DVC Contracts

Disney Vacation Club (DVC) resale listings provide prospect...

Buying DVC Resale

Guide to Buying DVC Resale Purchasing DVC resale provides a...

Why Use DVC Sales

Choosing the right DVC resale broker significantly impacts...

Best Place to Buy DVC Resale

Finding the best place to buy DVC resale points involves e...

Best DVC Resale Company

Finding the best DVC resale company requires evaluating mul...

DVC Buy Resale

DVC Buy Resale: Your Complete Guide to Secondary Market Purc...

DVC Resale Listings

Disney Vacation Club (DVC) resale listings provide an excel...

Disney DVC Resale Search Engine

Disney DVC Resale Search Engine Overview Finding the right...

DVC Resale Listings Search Engine

DVC Resale Listings Search Engine Guide Searching for...

DVC Resale Search Engine

DVC resale search engines help buyers find available Disney...

DVC Resale Aggregator

DVC Resale Aggregator Services DVC resale aggregators compi...

Disboards DVC Resale

Disboards and DVC Resale Information The DIS (Disney...

Disadvantages of Buying DVC Resale

While buying DVC resale offers substantial cost savings, pr...

Cons of Buying DVC Resale

Cons of Buying DVC Resale: Understanding the Trade-offs...

Resales DVC

Resales DVC: Your Guide to the Secondary Market Resal...

DVC Resale

DVC Point Resale

Understanding DVC Point Resale DVC point resale involves pu...

DVC for Resale

DVC for Resale: Your Complete Buying Guide Purchasing DVC t...

DVC Timeshare Resale

DVC as a Timeshare Product Unlike traditional week-based ti...

Resale DVC Points

How DVC Points Work DVC points serve as vacation currency th...

DVC by Resale

DVC by Resale: Your Guide to Secondary Market Purchases Acq...

DVC Contract Resale

DVC Contract Resale: Buying and Selling DVC Ownership DVC c...

DVC Resale Contracts

DVC Resale Contracts: What Buyers Should Know DVC resale co...

Buying DVC Resale Pros and Cons

Buying DVC resale offers significant advantages but also in...

Buying DVC Direct vs Resale

Deciding between buying DVC direct from Disney versus purch...

Buying DVC from Disney or Resale

When it comes to Disney Vacation Club, the biggest decisio...

DVC Resale Value

Understanding the DVC resale value is essential for anyone...

DVC Resale vs Direct

DVC Resale vs Direct: Comparing Your Purchase Options When...

DVC Direct vs Resale

DVC Direct vs Resale: Making the Right Choice Choosing betw...

DVC Resales Value

DVC Resale vs Direct

DVC Resale vs Direct: Understanding Your Purchase Options W...

DVC Resale Market

DVC Resale Market: Understanding How It Works The DVC resal...

DVC Resale Limitations

Disney DVC Resale Restrictions

Disney DVC Resale Restrictions: What Buyers Need to Know Di...

DVC Resale Restrictions

Disney Vacation Club (DVC) resale restrictions represent l...

Best DVC Resort to Buy Resale

Best DVC Resale

Finding the Best DVC Resale Identifying the best DVC resa...

Cheapest DVC Resale

Finding the Cheapest DVC Resale Points Disney Vacatio...

Average DVC Resale Prices 2025

Average DVC Resale Prices

Average DVC Resale Prices Overview Understanding average DV...

DVC Resale Prices

Resort Impact on Pricing Resort location represents the most...

Where Can I Use DVC Resale Points

Where Can I Use DVC Resale Points? Understanding where you...

Buy DVC Points: What You Need to Know Page title

Understanding DVC Points Basics DVC points function as vacat...

Disney Vacation Club

Disney Vacation Club: Understanding DVC Membership Disney V...

disney vacation club point chart

Understanding the Disney Vacation Club Point Chart The DVC...

DVC Resort Expiration

Every Disney Vacation Club resort has a specific expiration...

DVC Resale vs. Retail

DVC Resale vs. Retail: Understanding Your Options Prospec...

Buying DVC Resale vs Direct

Choosing between buying DVC resale versus purchasing direct...

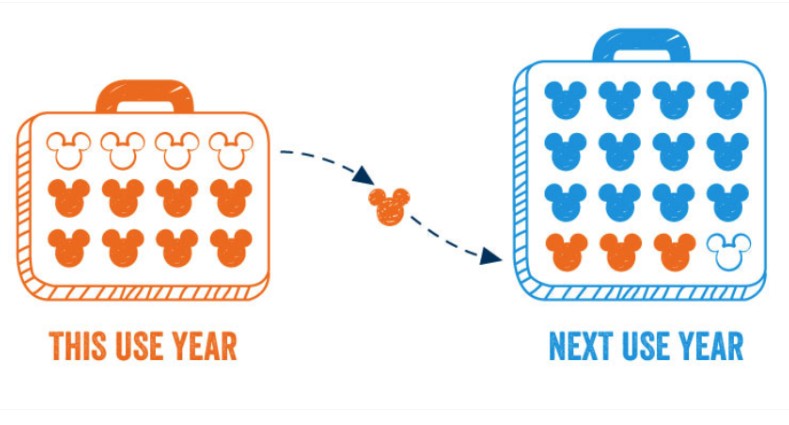

Banking and Borrowing DVC Points

Learn how to bank and borrow DVC points to maximize your vacation flexibility.

Home Resort Priority

Understanding the 11-month and 7-month DVC booking windows and how Home Resort Priority works.