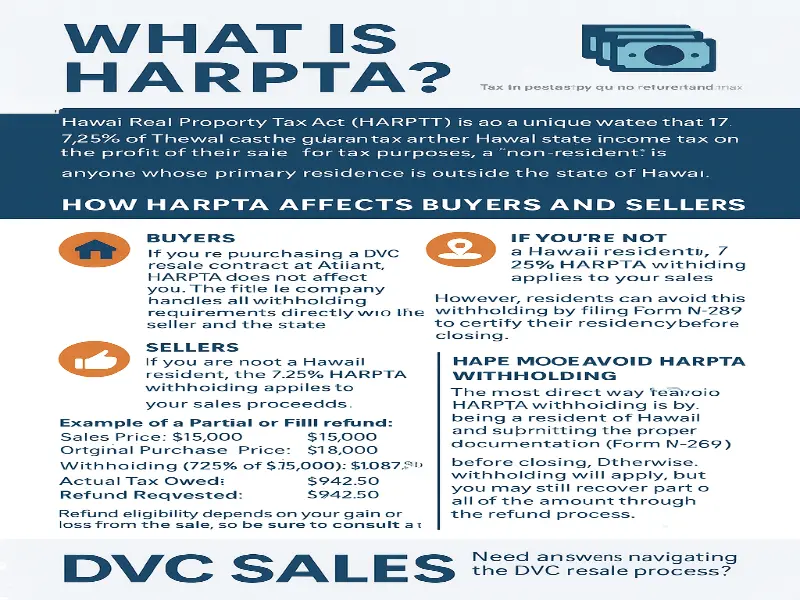

What Is HARPTA?

The Hawaii Real Property Tax Act (HARPTA) is a state law that requires non-resident sellers of Hawaii real estate to withhold 7.25% of the gross sales price and submit it to the Hawaii Department of Taxation. This ensures non-residents pay any due Hawaii state income tax on the profit of their sale.

For tax purposes, a "non-resident" is anyone whose primary residence is outside the state of Hawaii. This law often impacts Disney Vacation Club (DVC) members who own points at Aulani, A Disney Resort & Spa, located in Ko Olina, Oahu.

How HARPTA Affects Buyers and Sellers

Buyers

If you're purchasing a DVC resale contract at Aulani, HARPTA does not affect you. The title company handles all withholding requirements directly with the seller and the state of Hawaii.

Sellers

If you are not a Hawaii resident, the 7.25% HARPTA withholding applies to your sales proceeds. However, residents can avoid this withholding by filing Form N-289 to certify their residency. This form must be submitted to the title company before closing.

HARPTA Refunds: When and How

If the amount withheld is more than the actual Tax owed on the sale, you may qualify for a partial or full refund. Sellers must file a Hawaii state income tax return at year-end to request a refund. In some cases, if no profit was made on the sale, a full refund may be granted earlier.

Example of a Partial Refund:

- Sales Price: $15,000

- Original Purchase Price: $13,000

- Withholding (7.25% of $15,000): $1,087.50

- Actual Tax Owed: $145

- Refund Requested: $942.50

Example of a Full Refund:

- Sales Price: $10,000

- Original Purchase Price: $13,000

- No profit was made

- Withholding: $725

- Refund Requested: Full amount

Refund eligibility depends on your gain or loss from the sale, so be sure to consult a tax professional.

How to Avoid HARPTA Withholding

The most direct way to avoid HARPTA withholding is by being a resident of Hawaii and submitting the proper documentation (Form N-289) before closing. Otherwise, withholding will apply, but you may still recover part or all of the amount through the refund process.

HARPTA and Disney Vacation Club Members

For DVC members who own at Aulani, A Disney Resort & Spa, HARPTA applies to most non-resident sellers. Unless you're a Hawaii resident with the correct paperwork, 7.25% of the sale price of your contract will be withheld. The good news? If you sell through DVC Sales, the process is handled for you. The title company automatically calculates the withholding and submits it to the state. For an additional fee, they can also help you apply for a refund.

To learn more about DVC resale listings or how long it takes to sell a contract, DVC Sales provides step-by-step resources to guide you.

Final Thoughts

HARPTA may sound overwhelming at first, but with the correct information and support, the process becomes manageable. If you're a DVC member selling your Aulani contract, it’s essential to understand how HARPTA works and what steps you can take to minimize or recover withheld funds.

Need assistance navigating the DVC resale process? Visit dvcsales.com or explore the official Disney Aulani page for more details on your ownership.

Frequently Asked Questions

Q1: What is HARPTA and why is it important for DVC owners in Hawaii?

HARPTA stands for the Hawaii Real Property Tax Act, which requires tax withholding when non-residents sell property in Hawaii. For Aulani DVC owners, understanding HARPTA is crucial when selling or transferring ownership to avoid unexpected costs.

Q2: Does HARPTA apply to Disney Vacation Club sales at Aulani Resort?

Yes, HARPTA applies to any property transaction in Hawaii, including Aulani, A Disney Resort & Spa. Non-resident sellers must comply with Hawaii’s withholding tax rules when selling their DVC ownership interest.

Q3: How can DVC members minimize HARPTA-related costs when selling?

By working with an experienced DVC resale specialist who understands Hawaii’s tax laws, you can manage the process efficiently. Learn more about how DVC resale listings help sellers handle legal and financial steps smoothly.

Q4: Are HARPTA and FIRPTA the same thing?

No. HARPTA applies only to Hawaii real estate, while FIRPTA (Foreign Investment in Real Property Tax Act) is a federal law concerning foreign sellers of U.S. property. If you plan to sell your Aulani contract, check Can I Sell Old Key West Points? for general guidance on the resale process.

Got Something on Your Mind?

Your email address will not be published. Required fields are marked *